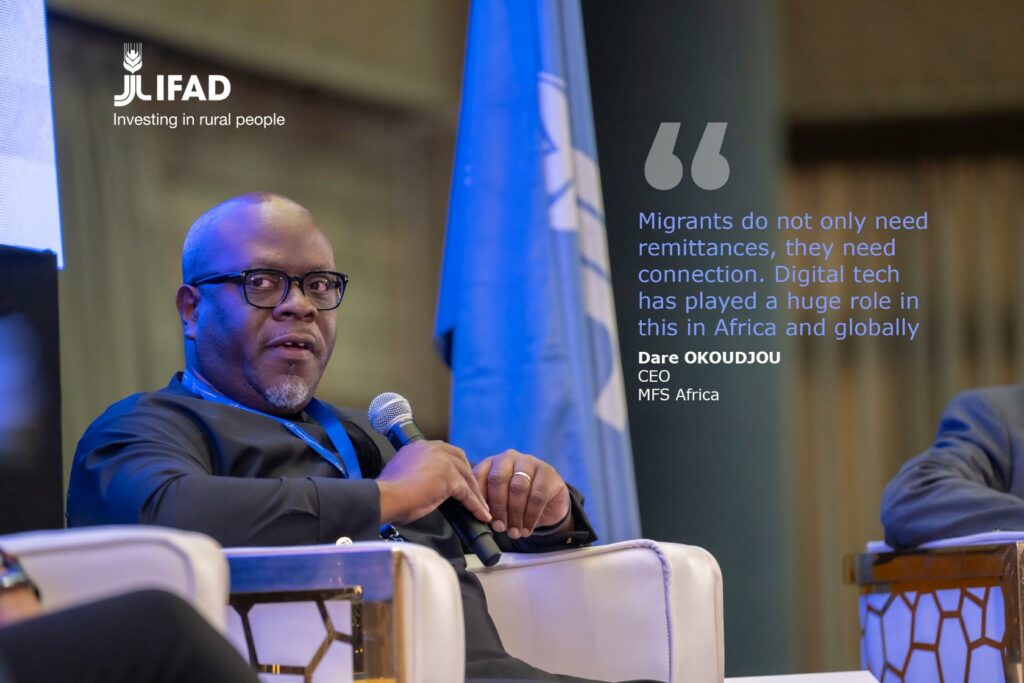

GFRID Summit 2023

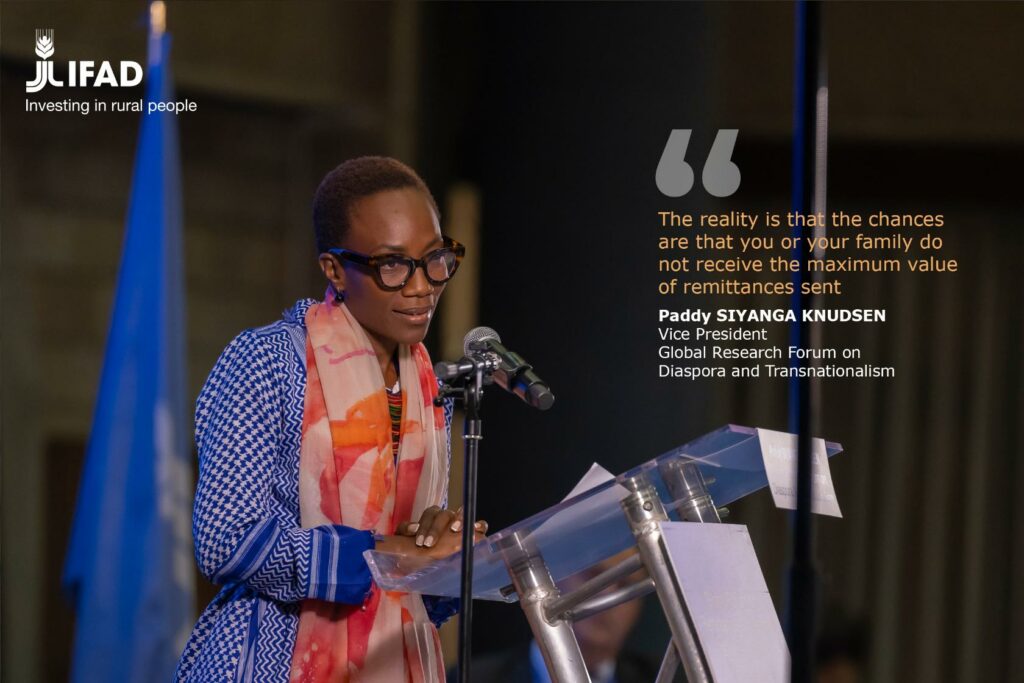

Promoted by the United Nations as a platform to engage all sectors, the GFRID Summit 2023 successfully took place at the UN Office at Nairobi (Kenya) on 14-16 June.

Over 600 global and African delegates attended the three-day event, discussing opportunities and challenges in the post-pandemic landscape, with a major focus on main remittance corridors and diaspora investment innovations in Africa.

As for every summit, the GFRID 2023 has facilitated networking among sectors, particularly through the Remittance Marketplace, as well as the exchange of best practices and the creation of synergies towards joint, innovative initiatives aimed at unleashing the power of remittances and diaspora investment towards sustainable development.

Photos and Video recordings of the GFRID Summit 2023 available through the following links:

VIDEO (parallel sessions in the afternoon):

VIDEO (parallel sessions for the entire day day):

GFRID Summit 2023

Promoted by the United Nations as a platform to engage all sectors, the GFRID Summit 2023 successfully took place at the UN Office at Nairobi (Kenya) on 14-16 June.

Over 600 global and African delegates attended the three-day event, discussing opportunities and challenges in the post-pandemic landscape, with a major focus on main remittance corridors and diaspora investment innovations in Africa.

As for every summit, the GFRID 2023 has facilitated networking among sectors, particularly through the Remittance Marketplace, as well as the exchange of best practices and the creation of synergies towards joint, innovative initiatives aimed at unleashing the power of remittances and diaspora investment towards sustainable development.

Photos and Video recordings of the GFRID Summit 2023 available through the following links:

VIDEO (parallel sessions in the afternoon):

VIDEO (parallel sessions for the entire day day):

Latest news about Summit

Main objectives

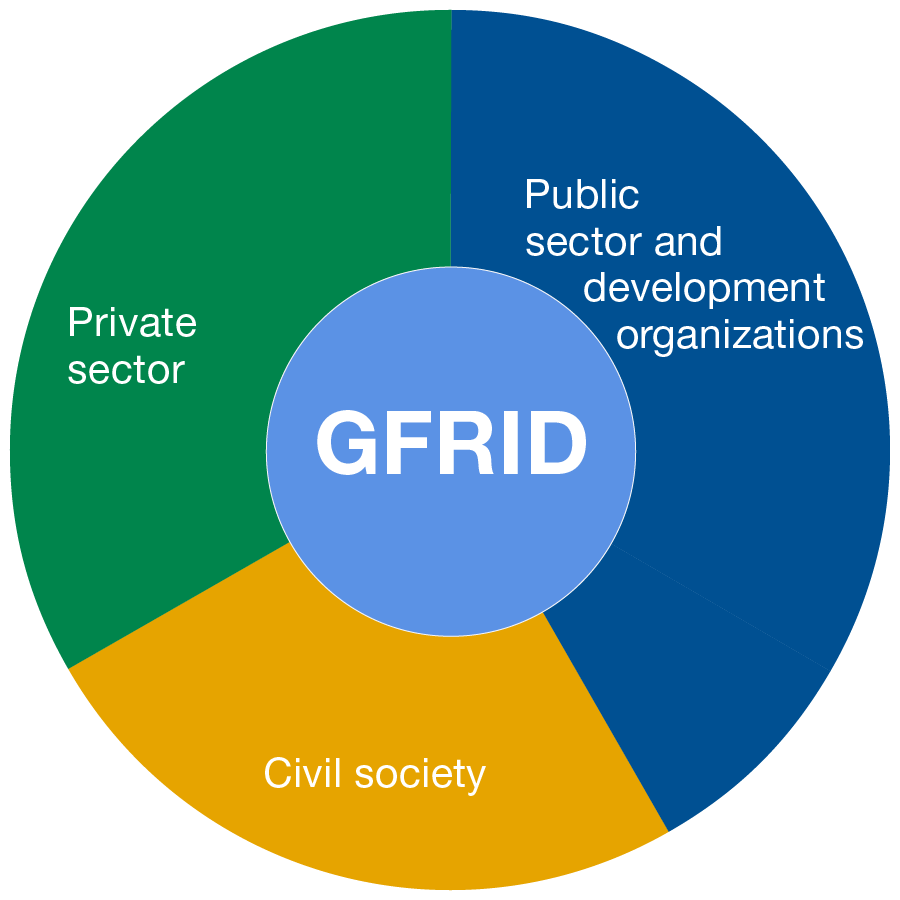

More than 600 attended the GFRID Summit, both from the region and globally. With its unique and inclusive format, the GFRID Summit 2023 aimed at:

Creating a process for continuous engagement among key African and global public and private sector representatives, as well as the civil society.

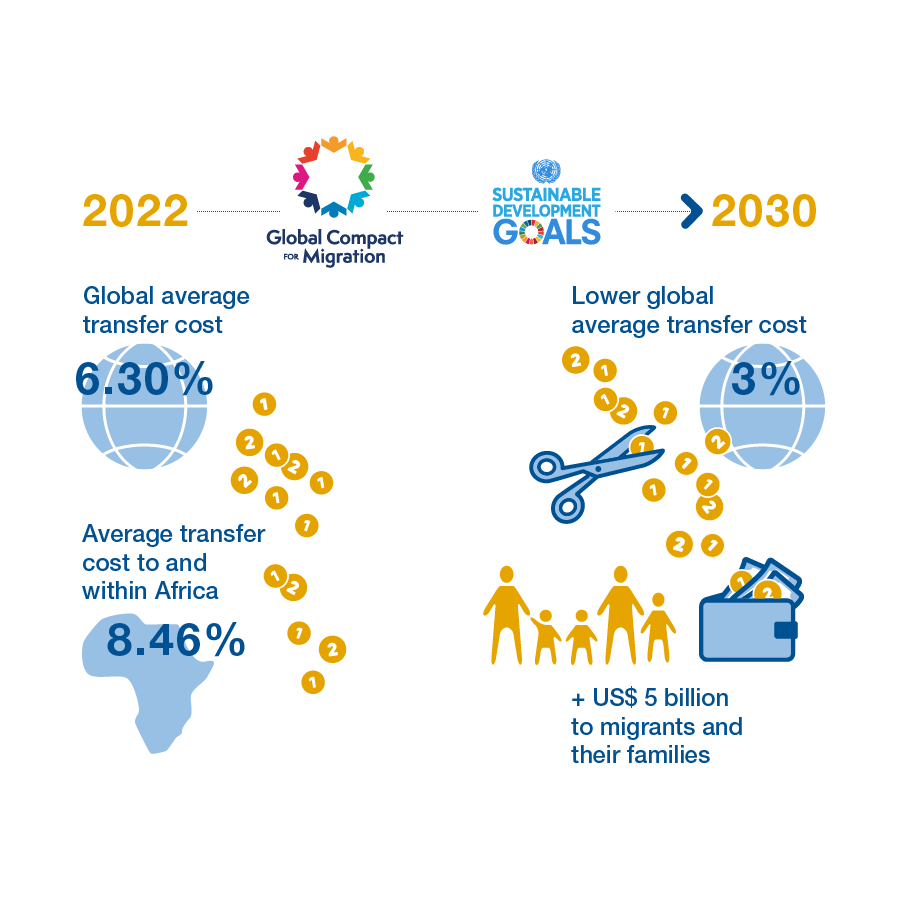

Promoting both African and global best practices to reduce the cost of remittances, while fostering financial inclusion through market competition, innovative business models and the use of disruptive technologies.

Developing multi-stakeholder strategies and partnerships to scale up successful financial vehicles involving migrant/diaspora contributions, through investment and entrepreneurship.

Contributing to global processes on remittances, investment and development, such as the SDGs achievement and implementation of the Global Compact on Migration.

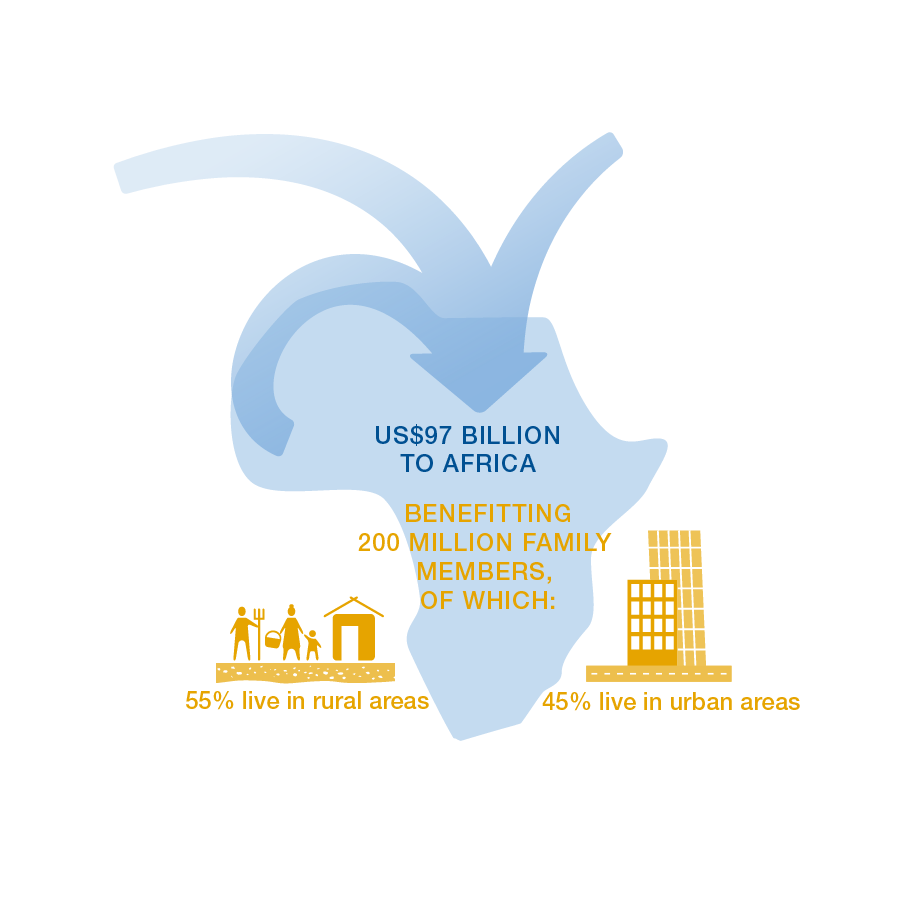

The African context

Source: RPW, Q3 2022 for sub-Saharan Africa, World Bank